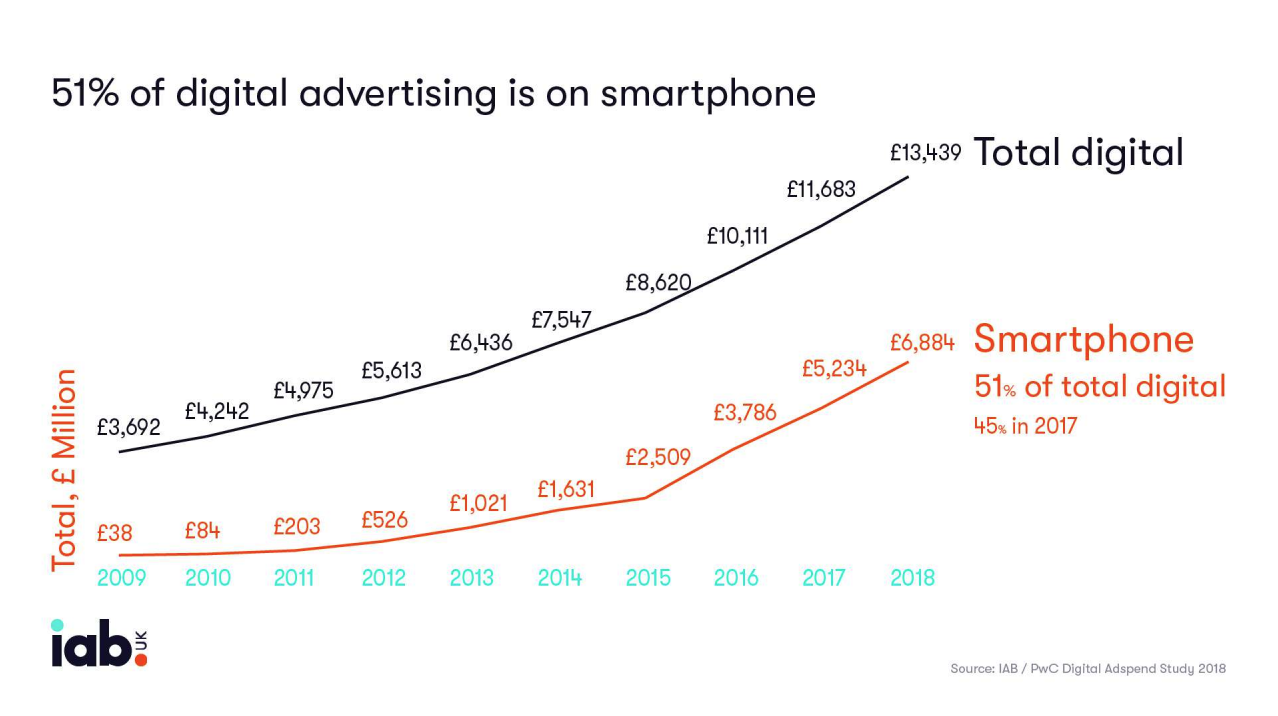

Those hailing each year since 2014 as ‘the year of the mobile’ may finally be satisfied – it seems 2018 was it. The IAB and PWC’s 2018 UK Digital Adspend report recently launched and, for the first time ever, ad spend on smartphones has exceeded desktop. Smartphone spend now accounts for over half (51%) of the total digital spend, with the digital advertising industry now firmly thinking mobile first.

Based on the UK ad revenues of 64 participants, plus additional recruitment sites and TV broadcasters, as reported by WARC, the latest IAB report paints a healthy digital picture. In 2018, UK advertisers spent £13.4bn on digital ads, an annual increase of £1.76bn and a 15% boost on 2017. Display ad spend is up 22% year-on-year, supporting display viewability figures within our recent H2 2018 Media Quality Report, which signaled an all-time high for UK desktop display viewability rates, reaching 68.8%, an improvement of 29.1% from the previous six months.

Moving towards mobile

Technological developments in both hardware and software, coupled with increasing internet speeds through the likes of 5G networks, are creating faster and more effective digital ecosystems. A natural fall out is mobile’s digital take over – the IAB results show that smartphone spend now accounts for a massive two thirds (66%) of total display ad spend.

As part of this, video ad spend has also grown and powered the majority of the growth in display spend. An engaging combination of auditory & visual stimulus, video is becoming one of the most effective means of capturing consumer attention. Marketers acted on this during 2018, with video ad spend now accounting for 44% of the total display market, making it the largest display format in the UK.

Video content is King

Video content is often consumed via social platforms – and within the IAB report, social media took a hefty chunk of the ad spend pie. Social revenue now totals £3.04bn, accounting for 23% of digital ad spend, an increase of 27% year on year – 58% of all display is being served in a social environment now. Unsurprisingly, 80% of social ad spend is spent on smartphones, whilst 57% of video budgets are invested in outstream, including social in-stream video. Social platforms still have some work to do, however – in our recent UK Industry Pulse report 70.2% of buy side respondents said that their social budgets will be impacted in 2019 without greater clarity into platforms. Social media platforms must act now, providing more meaningful insight into performance and measurement, or risk losing greater budget allocations.

What’s in store for 2019?

Looking into 2019, based on findings from IAS’s latest UK Industry Pulse report, lack of transparency, ad fraud and brand safety are most likely to impact the industry’s allocation of digital ad spend in 2019. Greater collaboration and increased transparency will help secure advertiser’s digital budgets this year and contribute to strengthening the whole digital ecosystem, enabling the healthy growth we have seen, continue.

However, as more brands adopt a video centric approach to their advertising campaigns, advertisers must be conscious of two things in particular. Firstly, the increased brand risk that accompanies video content. In order to mitigate the increased risk , advertisers should work with a brand safety vendor to monitor and block risky content to protect video spend. Secondly, advertisers must regularly analyse video data to ensure the most effective content is delivered. A third party, such as IAS, can provide clients with data driven insights on where spend is most effective, enabling advertisers to optimise their media buy.

The door of opportunity for advertisers to reach consumers, with quality content, is wide open. We can clearly see that consumers are more than willing to engage with video content and now is the time for brands to develop dynamic digital content strategies. Similarly, whilst advertisers continue to think mobile first, 2019’s digital spend figure is going to soar to new heights and we expect to see continued growth in video, but also see technology such as OTT and audio come into greater focus.

Share on LinkedIn

Share on LinkedIn Share on X

Share on X